For months, many people have been asking the same question. They want to know if the AI market is in a bubble. They want to know if the fast growth in AI companies is real or if it will suddenly drop one day. But Nvidia’s new earnings report has changed the conversation. With record revenue of 57 billion dollars in one quarter, Nvidia has sent a clear message. The AI market is not slowing down. Instead, it is growing even faster than before.

In this post, I will break down what Nvidia reported, why it matters, and why this result is now calming fears of an AI bubble. I will use very simple words so anyone can understand the full story.

Nvidia’s biggest quarter ever

Nvidia reported 57 billion dollars in revenue for the third quarter. This number is 62 percent higher than the same quarter last year. It is also higher than what Wall Street expected. The company also reported 32 billion dollars in net income which is profit after expenses. That number is 65 percent higher than last year.

These numbers shocked many people in the tech and finance world. Many investors were worried that Nvidia would slow down because the AI market looked very hot. But instead of slowing down, Nvidia grew even faster.

This strong performance is one reason why talk about an AI bubble is suddenly quiet. When a company beats expectations by this much, it shows that demand is real and not based on hype.

The data center business is driving the boom

The biggest reason for Nvidia’s record revenue is its data center business. Data centers are very large computer systems that companies use to run AI models, store data, and handle cloud services. This part of Nvidia’s business made 51.2 billion dollars this quarter. That is a record number and it makes up most of Nvidia’s total revenue.

Revenue from data centers grew 25 percent from the last quarter and 66 percent from the same quarter last year. Nvidia says this massive growth is because the world needs more computing power for AI. More companies want to train AI models and use them for real products.

Nvidia’s CFO, Colette Kress, explained it very clearly. She said the company is seeing strong demand for AI models, agentic AI, and powerful systems that can handle very large tasks. She also said Nvidia announced AI factory and infrastructure projects that include around 5 million GPUs. This is a huge number and it shows how much global demand for AI hardware is rising.

Blackwell GPUs are flying off the shelves

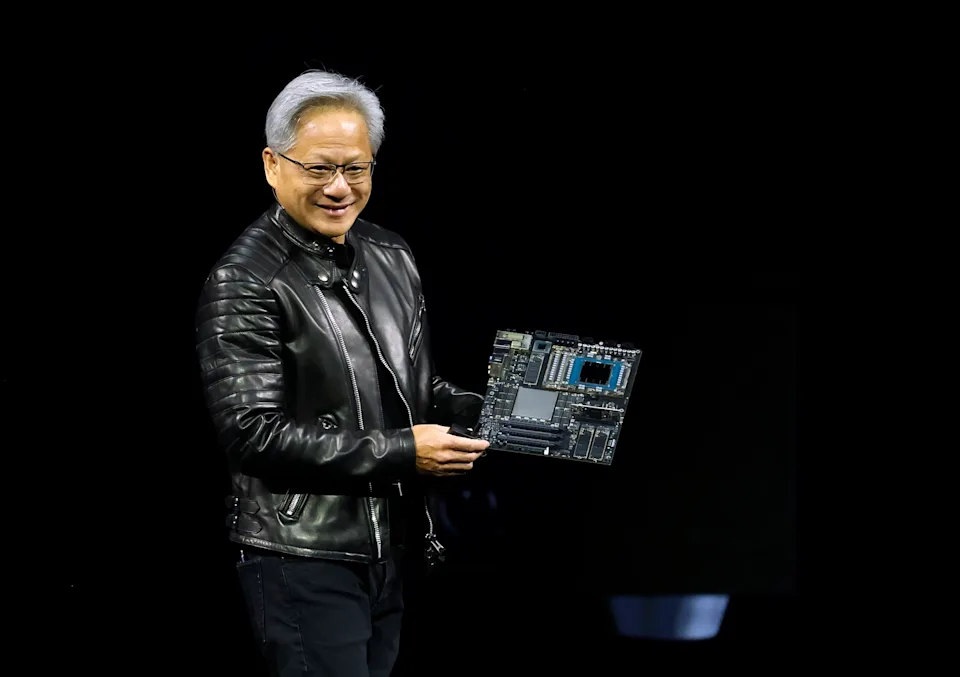

One of the star products behind this growth is the Blackwell Ultra GPU line. Nvidia released it earlier this year, and it has quickly become the top choice for AI training and AI workloads. Jensen Huang, Nvidia’s CEO, said the sales are “off the charts.” He also said cloud GPUs are sold out.

When GPUs are sold out, it means companies are buying them faster than Nvidia can produce them. This is a strong sign that AI growth is not slowing down. Companies like Amazon, Google, Meta, Microsoft, and many government groups are buying GPUs at an incredible rate. They need more computing power to train new AI models, build AI systems, and support users around the world.

This strong demand for Blackwell GPUs shows that Nvidia still has a big lead in the AI chip market. While other companies are trying to compete, Nvidia is still far ahead when it comes to speed, quality, and production scale.

Nvidia’s clear message about the AI bubble

Since 2024 and 2025, many people have been talking about an AI bubble. They say AI companies are growing too fast. They think the market may crash one day. But Jensen Huang has a different view. During the earnings call, he said there is no bubble. He said the company sees something very different from the inside.

Huang said demand for computing keeps growing in every part of the world. He also said demand for training and inference keeps compounding which means it keeps building on top of itself. He believes we have now entered a “virtuous cycle” where AI growth feeds more AI growth.

This message from Nvidia’s CEO is important because Nvidia is the center of the global AI movement. If anyone knows what is really going on inside the AI market, it is Nvidia.

Problems with China did not slow Nvidia down

Even with this huge success, Nvidia did face one problem. The company could not sell many of its H20 chips in China. The H20 is a data center GPU designed for generative AI and high performance computing. Nvidia said it shipped 50 million H20 units, which was lower than expected because the company cannot sell stronger chips to China due to United States restrictions.

Even with this setback, Nvidia still broke records. This shows that the company can still grow even when one large market has limits.

A strong forecast that pushes fear away

Nvidia is not only reporting strong numbers, it is also predicting more growth. The company says it expects 65 billion dollars in revenue for the next quarter. This forecast is very high and above what analysts expected. The moment Nvidia shared this number, its stock price went up more than 4 percent in after hours trading.

This growth forecast plays a big role in calming AI bubble talk. If the company expects more demand in the next quarter, it means AI spending is still rising.

The Bottom Line

Nvidia’s record 57 billion dollar quarter shows that the AI world is not slowing down. The company did not only beat expectations, it crushed them. With a strong data center business, high demand for Blackwell GPUs, and a forecast of 65 billion dollars for the next quarter, Nvidia has shown that the AI boom is still going strong.

For now, fears of an AI bubble have become very quiet. Nvidia’s numbers speak louder than any prediction. The AI wave is not stopping. It is only getting bigger.

Also Read:The Circular Money Problem at the Heart of AI’s Biggest Deals