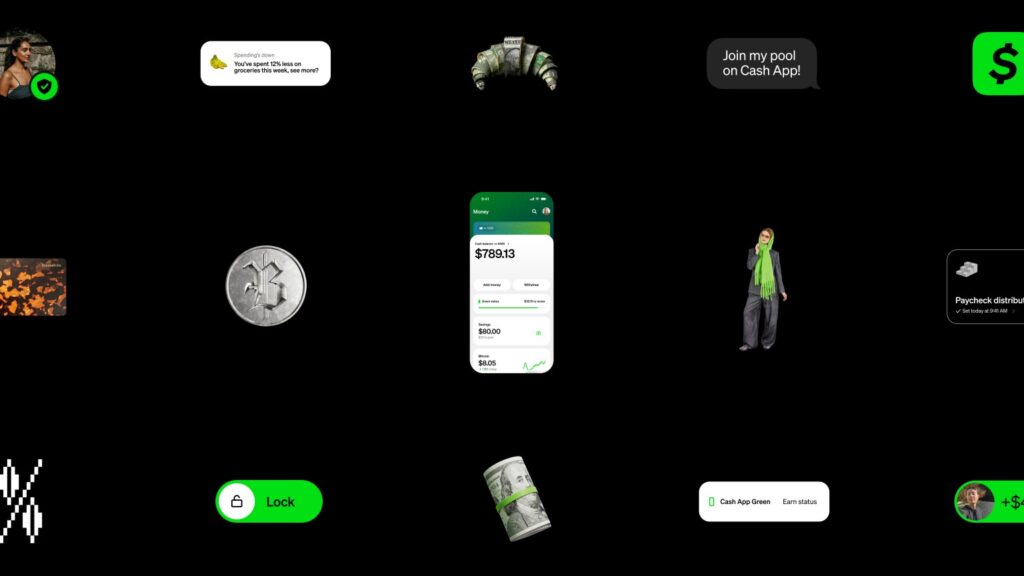

Cash App, the popular money transfer app, has just introduced a new tool called Moneybot, an AI assistant that helps users understand their finances in simple ways. The company says the goal is to make money management easier for everyone, even for people who are not good with numbers or technology.

This new update is part of Cash App’s effort to become more than just an app for sending or receiving money. With the new AI assistant, users can now ask questions like “How much did I spend on food this month?” or “What is my account balance?” and get answers instantly.

Let’s break down what this means, how it works, and why it could be a big deal for everyday users.

What Exactly Is Cash App’s New AI Assistant?

The new feature is basically a smart chatbot built into the Cash App. It uses artificial intelligence to answer your financial questions in real time. Think of it as a friendly guide inside your app that helps you understand your money better.

You can type or talk to it just like you would with a friend. It looks at your spending history, your deposits, and other financial data already available in the app, then gives you easy-to-understand answers.

For example, if you ask, “How much did I spend on Uber this week?” the AI will quickly check your transaction list and tell you the total. If you ask, “Do I have enough money to pay my rent?” it will give you a simple answer based on your balance.

Why Cash App Added an AI Assistant

Cash App wants to make managing money less stressful. Many people find it hard to track their spending or understand where their money goes each month. By using AI, Cash App hopes to make this easier and more personal.

The company said that this new feature is designed to help users make better financial choices. Instead of looking through endless lists of transactions, you can just ask a question and get the answer right away.

This is also part of a larger trend where fintech apps are adding AI tools to make financial services smarter and more helpful. Competitors like PayPal, Venmo, and Apple Pay are also exploring similar tools. But Cash App’s new feature stands out because it focuses on financial education and personal money insights.

How It Works

The assistant, named Moneybot, works directly inside the Cash App. You can find it in the help or chat section. Once you open it, you can start asking questions about your account, your payments, and your spending patterns.

The AI uses machine learning to understand your financial behavior. It studies how you spend, where you spend, and how often you move money. Then it gives you insights in plain language.

It can do things like:

- Summarize your spending by category

- Show how much money you received this month

- Help you create simple savings goals

- Answer common questions about your Cash App balance or Cash Card

Cash App promises that all conversations are private and protected. Your data stays secure, and the assistant only uses your information to help you manage your account.

Why This Could Be a Game Changer

This new AI feature could change how people interact with their money. Instead of logging into your bank app and trying to figure out numbers yourself, you can simply ask questions and get fast answers.

For people who live paycheck to paycheck, this tool could help them see where their money goes every week. For young users, it can be a simple way to learn basic financial habits.

It also saves time. Many people check their balance several times a day or look for one specific payment. Now, they can ask the AI and get an answer in seconds.

In the future, Cash App might expand this assistant to do more things, like suggesting how to save money, find discounts, or manage bills automatically.

What Users Are Saying

Early users who tested the feature say it feels like chatting with a friend about money. It’s not complicated, and the answers are short and easy to understand.

Some users also like that it helps them see their spending patterns clearly. One user said that after using Moneybot, they realized they were spending too much on food deliveries and decided to cut back.

The simple design and friendly tone make it useful even for people who are not tech-savvy.

What This Means for the Future of Money Apps

This new update shows that financial apps are no longer just about sending and receiving money. They are becoming smart personal finance assistants.

As more people rely on digital wallets, apps like Cash App will need to offer features that actually help users understand and grow their money. AI assistants are becoming the next big step in that direction.

By adding Moneybot, Cash App is joining the race to use artificial intelligence to make banking more personal, helpful, and easy.

The Bottom Line

Cash App’s new AI assistant is another sign that the future of money management is becoming smarter and simpler. Instead of confusing numbers and spreadsheets, users can now get answers through an easy chat experience.

It might take some time before everyone fully trusts AI for financial advice, but this move by Cash App is a strong start.

If you already use Cash App, keep an eye out for the new Moneybot feature. It could soon become one of the most useful parts of your financial life.

Also Read:The Circular Money Problem at the Heart of AI’s Biggest Deals